Austria became a big investor in Ukraine’s energy sector last month when Andritz Hydro, a subsidiary of Austrian technology group Andritz, announced a major hydroelectric power station modernization program on the Dnipro River.

The 60-million euro project concerns the Dnipro 1 hydroelectric plant in the city of Zaporizhzhya — some 520 kilometers southeast of the Ukrainian capital Kyiv.

Andritz Hydro, headquartered in Vienna, has 50 offices spread across 25 countries. The company said in a press release that its involvement in the Dnipro 1 venture would “strengthen its position” in Ukraine’s “growing hydropower market.”

Dnipro 1, which was built between 1927 and 1932, was Ukraine’s first hydroelectric power station. Today it is just one of nine hydroelectric plants operated by state-run enterprise Ukrhydroenergo.

The hydroelectric plant’s modernization forms part of a larger program financed by the European Bank for Reconstruction and Development which was first announced in 2011. The bank, which remains the largest financial investor in Ukraine, said at the time that hydro would play a key role in Ukraine’s power sector and that the country needs to “develop and maintain reliable sources of renewable energy.”

It is hoped that the modernization of the Dnipro 1 plant will advance that agenda, with Andritz Hydro suggesting that upon completion of the work — scheduled for the end of 2021 — the total contribution to the country’s electricity supply made by Ukrhydroenergo will exceed 15 percent.

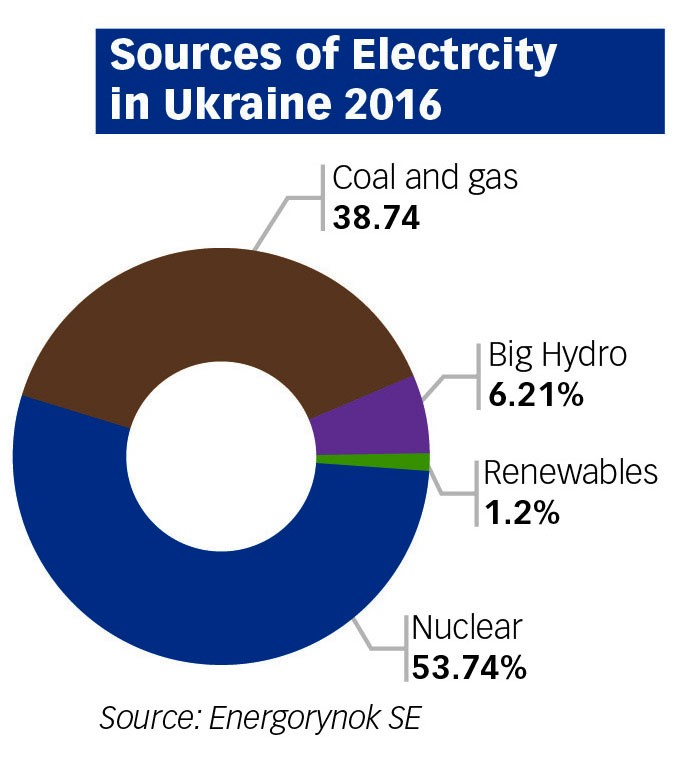

That would represent a significant jump from the 6.2 percent the company currently provides, according to figures from consultancy Ernst and Young.

But those numbers don’t tell the whole story. As Ernst and Young’s cleantech and sustainability services expert Andrii Kitura points out, large hydroelectric power plants such as those run by Ukrhydroenergo “aren’t normally considered as renewables.”

True “green” sources of energy — in the form of solar power, wind, biomass and small hydro — currently account for just 1.2 percent of electricity generation in Ukraine.

Market development

However, that figure may be set for a boost in the coming years, according to Daniel Bilak, the director of Ukraine’s Investment Promotion Office. He says that there is considerable interest in Ukraine’s renewable energy sector, both in terms of entirely new projects and in moves to upgrade Soviet-era facilities.

The most high-profile of such ventures is in the Chornobyl exclusion zone, where Chinese investors are seeking to repurpose infrastructure left over after the site’s infamous nuclear meltdown in the construction of solar power stations.

“The attractive part of that is that they have all the grid hookups from the nuclear power plant,” Bilak told the Kyiv Post. “There’s been considerable international interest, which we’ve been helping to facilitate.”

Game changer

The attractiveness of Ukraine’s energy sector as an investment pros pect grew further when on April 13 parliament adopted a draft law to liberalize the electricity market. The new legislation foresees the elimination of the single state-controlled operator which currently buys all the electricity produced in the country.

Instead, power producers will be able to sign direct contracts with consumers or businesses, at a price that won’t be regulated. Bilak described the new law as a “game changer.”

But for producers of electricity from renewable sources the new legislation, at least in one key aspect, will not change very much. Many of them already benefit from the so-called “green tariffs” introduced in 2008, which guarantee until 2030 higher returns on power produced from renewable energy sources. The tariffs are set to stay in place under the new electricity market model.

“Today the buyer of green electricity is the state-owned company Energorynok,” said Oleksiy Orzhel, the head of the Ukrainian Association for Renewable Energy.

“In the new market, after the passage of this new law, there will still be a specific entity that will be called ‘the guaranteed buyer,’ that will have to buy electricity generated from renewable sources. There is no difference; it will be the same rules and the same tariffs. There is no risk.”

https://www.kyivpost.com/wp-content/uploads/2017/04/08-1-267x300.jpg 267x, https://www.kyivpost.com/wp-content/uploads/2017/04/08-1-579x650.jpg 579x, https://www.kyivpost.com/wp-content/uploads/2017/04/08-1-660x740.jpg 660x" sizes="(max-width: 556px) 100vw, 556px">

https://www.kyivpost.com/wp-content/uploads/2017/04/08-1-267x300.jpg 267x, https://www.kyivpost.com/wp-content/uploads/2017/04/08-1-579x650.jpg 579x, https://www.kyivpost.com/wp-content/uploads/2017/04/08-1-660x740.jpg 660x" sizes="(max-width: 556px) 100vw, 556px">

New energy, old issues

According to the national action plan Ukraine set for itself in 2014, a total of 11 percent of the country’s electricity should come from renewable sources by 2020. In this calculation, big hydro stations such as Dnipro 1 are taken into account. But even with the increased capacity they will provide after modernization, Ukraine is set to miss its target by about 3 percent if there is no new investment.

Orzhel says he believes there is an appetite for fresh projects which could boost the share of electricity coming from renewable sources by a third as soon as this year. But a lack of clarity from Ukraine’s energy regulator over new connections to the electricity grid is sowing uncertainty.

“The problem is that right now a lot of investors are waiting for the new rules,” he said. “These planned changes regarding the regulations are very harmful to development.”

Whilst such regulatory details could be worked out in a relatively short time frame, in the long term the barriers to attracting more investment in green energy are the same as the ones which hamper growth elsewhere in the economy. The war in the Donbas with Russia is just one — there is a host of other factors, including “imperfect legislation and courts,” according to consultant Kitura.

Nevertheless, “renewables have great potential for growth the world over, and also in Ukraine,” he said.

“However, this business is accompanied by risks and a long payback period. I would say that the key problem for the development of renewable energy in Ukraine is the low investment attractiveness of the country.”

But at least for now, that hasn’t put off Austria’s Andritz Hydro.

Source: Kyivpost